This amount comes after deducting all expenses for a period from the total income. When these amounts accumulate for several periods, they go to the retained earnings account. However, these amounts only include profits not paid to shareholders in previous periods.

- As a result of higher net income, more money is allocated to retained earnings after any money spent on debt reduction, business investment, or dividends.

- Retained earnings reflect the company’s net income (or loss) after the subtraction of dividends paid to investors.

- It’s often the most important number, as it describes how a company performs financially.

- This profit is often paid out to shareholders, but it can also be reinvested back into the company for growth purposes.

What Factors Impact Retained Earnings?

- Retained earnings may be used to acquire new assets, pay off debts, or finance operations.

- Shareholder equity represents the amount left over for shareholders if a company pays off all of its liabilities.

- Understanding retained earnings is essential for anyone involved in business.

- Negative retained earnings are a sign of poor financial health as it means that a company has experienced losses in the previous year, specifically, a net income loss.

- For example, companies often prepare comparative income statements to analyze reports over several years.

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first are retained earnings an asset or liability six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

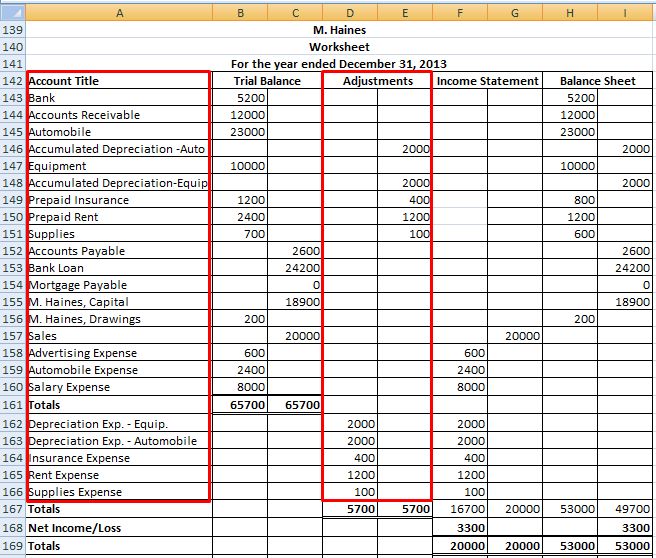

How to Calculate Retained Earnings

At each reporting date, companies add net income to the retained earnings, net of any deductions. Dividends, which are a distribution of a company’s equity to the shareholders, are deducted from net income because the dividend reduces the amount of equity left in accounting the company. Retained earnings are recorded in the shareholder equity section of the balance sheet rather than the asset section and usually do not consist solely of cash. Dividend payments can vary widely, depending on the company and the firm’s industry. Established businesses that generate consistent earnings make larger dividend payouts, on average, because they have larger retained earnings balances in place.

Where Is Retained Earnings on a Balance Sheet?

By investing in research and development, businesses can develop innovative products and services and maintain a competitive edge in the market. Similarly, the iPhone maker, whose fiscal year ends in September, had $70.4 billion in retained earnings as of September 2018.

- If the company is experiencing a net loss on its Income Statement, then the net loss is subtracted from the existing retained earnings.

- Over time, retained earnings can have a significant impact on a company’s growth and profitability.

- Net income is often called the bottom line since it sits at the bottom of the income statement and provides detail on a company’s earnings after all expenses have been paid.

- Lower retained earnings can indicate that a company is more mature, and has limited opportunities for further growth, but this isn’t necessarily a negative.

- She supports small businesses in growing to their first six figures and beyond.

A report of the movements in retained earnings is presented along with other comprehensive income and changes in share capital in the statement of changes in equity. It is recorded into the Retained Earnings account, which is reported in the Stockholder’s Equity section of the company’s balance sheet. The amount is usually invested in assets or used to reduce liabilities.

Retained earnings are the amount of net income a company has left after dividends have been paid to shareholders. They can be used for a variety of purposes, such as capital investments, debt reduction or expansion. This capital has the potential to increase over time, and is a valuable asset to shareholders. Retained earnings do not belong to the company, but to the shareholders.They can be reinvested in the company or distributed to shareholders as dividends. The funds are used to pay shareholders in the form of dividends or compensation, and while they are not considered assets of the company, they are an additional equity shareholder capital. They both may see them as working capital to pay off high-interest debt or invest in growth that will make the company even more profitable given some more time.