Operating expenses are necessary costs for conducting daily business activities. Understanding operating costs helps you manage your business finances and make the most of your tax-deductible expenditures. We’ll explore the definition of operating costs, how to calculate operating costs, and what you can and cant write off with business travel how to distinguish them from other common business expenses. Operating expenses are the expenses that you incur as a business mandatorily because they help you to carry out business operations. You can also write off the total operating expense for the year in which you incur as an expense.

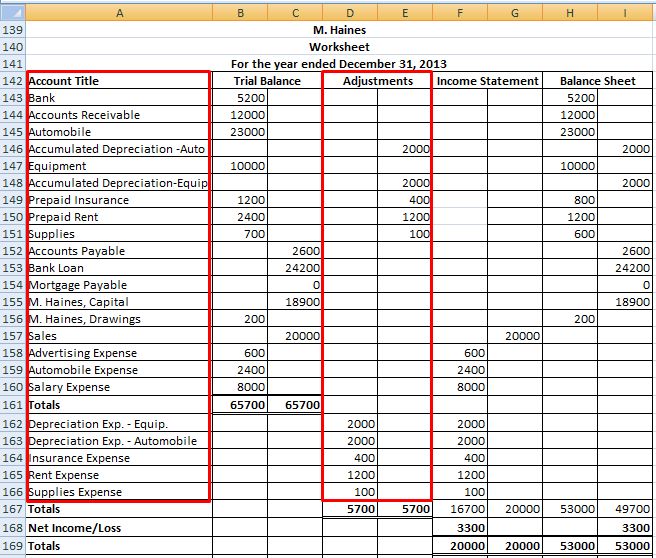

Detailed Financial Reports

However, the potato supplier may offer the restaurant chain a price of $0.45 per pound when it buys potatoes in bulk amounts of 200 to 500 pounds. Volume discounts generally have a small impact on the correlation between production and variable costs, and the trend otherwise remains the same. A semi-variable cost is similar to a smartphone with a limited data plan.

What are operating expenses?

The total cost formula is important because it helps management calculate the profitability of their business. It helps managers pinpoint which fixed or variable costs could be reduced to increase profit margins. It also helps managers determine the price point for their products and compare the profitability of one product line versus another.

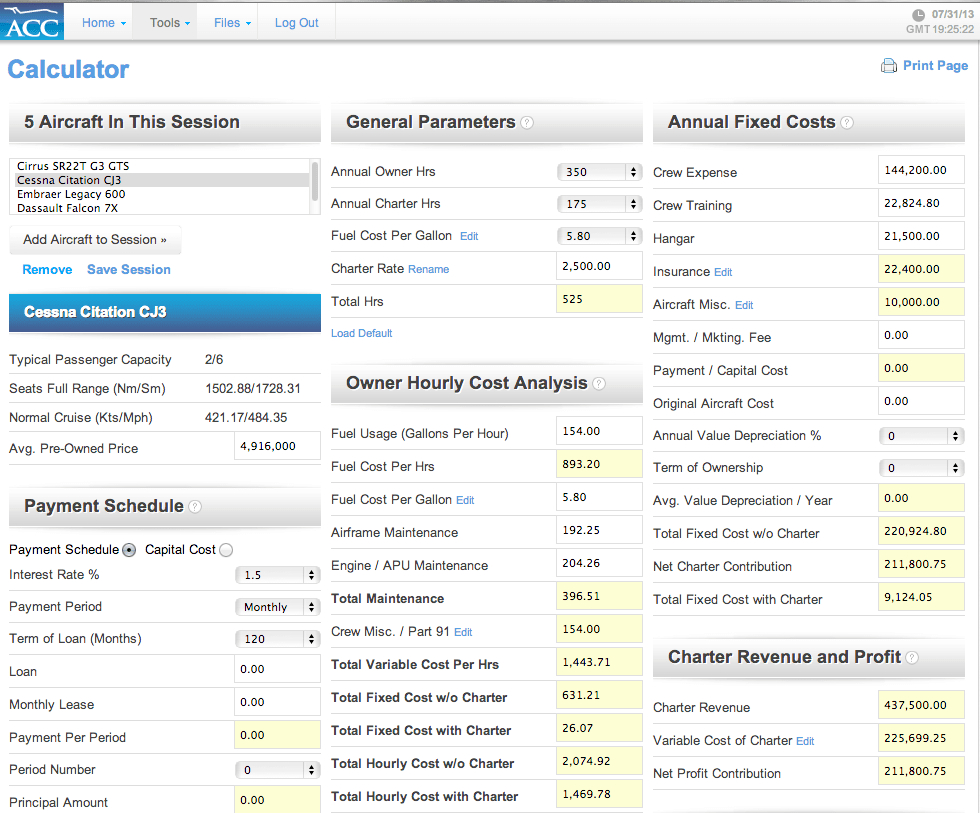

Technology’s role in managing operating costs

In addition, economies of scale enable large organizations to offer the same products as smaller organizations for lower prices. Entrepreneurs can compute their business’s variable cost by multiplying the quantity of the output by the output’s variable cost per unit. Operating expenses are represented on a balance sheet as a liability. Because they are a financial expense that does not directly contribute to selling services or products, they aren’t considered assets. FreshBooks expense tracking software makes it a breeze to track and organize all your operating expenses.

Financial Accounting Treatment

- In other words, variable costs decrease or increase based on the production level.

- This contrasts with operating costs, which are paid for through revenue generated from sales.

- This is demonstrated in the cash flow statement, where the purchase of an asset falls under investing activities.

- Operating costs illuminate the health of daily operations, painting a vivid picture of a company’s efficiency.

Every product sold needs to at least generate enough revenue to cover the fraction of operating costs attributable to its production and sale. If a business underestimates its operating costs, it may incorrectly set lower prices and will likely face difficulties trying to cover these costs, inevitably damaging profitability. By understanding the difference between fixed and variable costs, it becomes easier to allocate resources, set appropriate pricing, and ultimately, improve profitability. If not managed well, an increase in these costs may lead to a decrease in profitability, even if sales are booming.

You can navigate challenges with agility and proficiency in managing operating costs. Cut down unnecessary expenses but ensure quality and growth don’t take a back seat while you’re at it. Operating costs illuminate the health of daily operations, painting a vivid picture of a company’s efficiency. It’s not just about the numbers but their story regarding sustainability, adaptability, and profitability. Having clear benchmarks allows for easier tracking of any deviations.

Diligent accounting of operating expenses keeps profits on growth for continued success. In addition to fixed and variable costs, it is also possible for a company’s operating costs to be considered semi-variable (or “semi-fixed”). These costs represent a mixture of fixed and variable components and can be thought of as existing between fixed costs and variable costs. Semi-variable costs vary in part with increases or decreases in production, like variable costs, but still exist when production is zero, like fixed costs. This is what primarily differentiates semi-variable costs from fixed costs and variable costs. Strong revenue is always a good sign that the company is performing well.

If you are looking to understand how our products will fit with your organisation needs, fill in the form to schedule a demo. Businesses balance short-term cost-cutting with long-term growth by ensuring immediate savings don’t hinder future opportunities or damage brand reputation. Gains or losses from the sale of assets, interest paid on loans, lawsuit settlements. One-time or infrequent, related to obtaining or upgrading physical assets.

The per-unit variable cost of production remains consistent for a given level of output, but the per-unit variable costs will increase as the volume of output increases. Your business profits may increase in the short-term if you choose to reduce specific operating costs, these decisions can impact business earnings in the long-run. These examples show how operating costs vary significantly across industries.

By eliminating these wastes, a business can significantly lower its operating costs. Incorporating lean methodologies or using just-in-time inventory management are a few examples of how companies can reduce waste. One of the approaches to manage operating costs involves optimizing energy usage within the organization. A company’s operating income is determined by subtracting operating costs from gross profit.

Capital costs are one-time expenditures that a company incurs when it buys assets that improve its operations for a long period, typically over a year. These costs, also known as capital expenditure or CapEx, could include expenses like purchasing a new property, upgrading equipment, or investing in technologies. Capital costs are considered an investment in the company’s future performance and productivity. On the other hand, if operating costs are overestimated, prices may be set too high compared to competitors offering the same goods or services, which could push customers away.