ITIN documentation frequently asked questions FAQs Internal Revenue Service

In lieu of sending original documentation, you may use an IRS authorized Certifying Acceptance Agent (CAA) or make an appointment at a designated IRS Taxpayer Assistance Center (TAC) location. To find a local CAA in your area, you can visit Acceptance Agent Program. CAAs can authenticate all the identification documents for the primary and secondary applicant. For dependents, they can authenticate the passport and civil birth certificate; however, they must send the original or certified copies of all other documents directly to the IRS. If you qualify for an exception, then file Form W-7 with your proof of identity and foreign status documents and supporting documentation for the exception. IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers.

When should I apply?

It’s important to keep in mind that the above time frames are estimates and that it may take a longer or shorter time to process your ITIN application. Once you have submitted your application, you can check the status of your ITIN application on the IRS website. At Expat CPA, we specialize in helping non-residents, US citizens and expats remain compliant with the latest IRS tax codes. In addition to dedicated support for W-7 form instruction, we can also help you determine your expat eligibility for Social Security and other federal benefits. Section 203 of the Protecting Americans from Tax Hikes Act, enacted on December 18, 2015, included provisions that affect the Individual Taxpayer Identification Number (ITIN) application process. Taxpayers and their representatives should review these changes, which are further explained in the ITIN Documentation Frequently Asked Questions, before requesting an ITIN.

USA.gov is the new centralized place for finding government benefits for health care, housing, food, unemployment, and more. Official websites use .gov A .gov website belongs to an official government organization in the United States.

- To learn about our professional expat tax preparation services, schedule a free consultation with us today.

- In subsequent years, when you have an ITIN, you will file your tax return as directed in the form instructions.

- A tax preparer who is both an Enrolled Agent and a CPA (New Hampshire) very well aware of the tax situation of US citizens living abroad.

- In addition to dedicated support for W-7 form instruction, we can also help you determine your expat eligibility for Social Security and other federal benefits.

- You may also choose to submit certified copies from the issuing agency instead.

What is the difference between a “certified” and a “notarized” document?

They are issued regardless of immigration status, because both resident and nonresident what is the operating cycle aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. A certified document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official stamped seal from the Agency. A notarized document is one that the taxpayer provides to a public notary who bears witness to the signing of the official document and affixes a seal assuring that the document is legitimate.

Q18: What should I do if I submitted my ITIN renewal request before the end of 2021 and did not receive my ITIN?

This guide will walk you through the renewal application process of your ITIN. From determining if your ITIN needs to be renewed, to gathering the necessary documentation, and submitting the form and federal tax return. By following this guide, you can ensure that your ITIN renewal process is smooth and without any delays. If you already have an ITIN but fail to submit a U.S. tax return in any given calendar year, your Individual Taxpayer Identification Number may expire. If this happens, you’ll need to resubmit all your materials – along with your most recently completed U.S. federal tax return. The standard processing time is still seven weeks, although the IRS points out that delays can last up to 11 weeks if the renewal paperwork is received during peak tax time (January 15 to April 30).

Forms & Instructions

You can apply for an ITIN any time during the year when you have a filing or reporting requirement. At a minimum, you should complete Form W-7 when you are ready to file your federal income tax return by the return’s prescribed due date. If the tax return you attach to Form W-7 is filed after the return’s due date, you may owe interest and/or penalties.

Applicants are permitted to include a prepaid Express Mail or courier envelope for faster return delivery of their documents. The IRS will then return the documents in the envelope provided by the applicant. To complete Form W-7, you will need to provide your personal information, including your full name, address, and date of birth. You will also need to provide documentation to prove your identity and foreign status, such as a passport, national ID card, or birth certificate. If you are applying for an ITIN for a dependent, you will also need to provide documentation to prove their relationship to you, such as a birth certificate or marriage certificate. Once you have gathered all of the necessary information and documentation, you can submit the completed Form W-7 to the IRS, either by mail or through an authorized acceptance agent.

You can mail the W-7 and documentation to the address in the Form W-7 Instructions. Bring it to your local IRS office, or use an acceptance agent (colleges, financial institutions, or accounting firms that are authorized by the IRS to assist applicants in obtaining ITINs). It’s also important to note that an ITIN does not authorize work in the U.S. or provide eligibility for Social Security benefits, its only purpose is for tax purposes. It’s recommended to renew the ITIN in a timely manner to avoid any delays or complications when filing taxes or carrying out other tax-related transactions.

You may be able to request a certified copy of documents at an embassy or consulate. However, services may vary between countries, so we recommend that you contact the appropriate consulate or embassy for specific information. If you’re a US citizen who regularly files taxes, you likely have a Social Security number. But if you’re a non-citizen, the Internal Revenue Service (IRS) still expects you to report taxes every year — for which you’ll need an Individual Taxpayer Identification Number (ITIN).

- Publicado en Bookkeeping

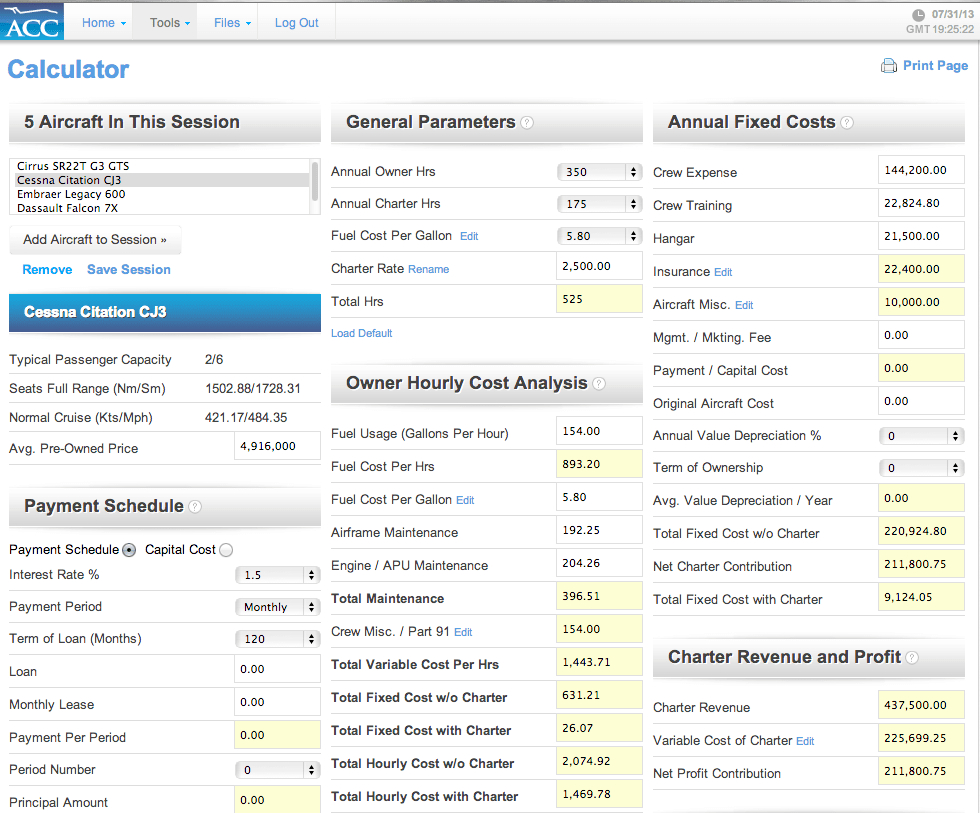

What are Operating Costs

Operating expenses are necessary costs for conducting daily business activities. Understanding operating costs helps you manage your business finances and make the most of your tax-deductible expenditures. We’ll explore the definition of operating costs, how to calculate operating costs, and what you can and cant write off with business travel how to distinguish them from other common business expenses. Operating expenses are the expenses that you incur as a business mandatorily because they help you to carry out business operations. You can also write off the total operating expense for the year in which you incur as an expense.

Detailed Financial Reports

However, the potato supplier may offer the restaurant chain a price of $0.45 per pound when it buys potatoes in bulk amounts of 200 to 500 pounds. Volume discounts generally have a small impact on the correlation between production and variable costs, and the trend otherwise remains the same. A semi-variable cost is similar to a smartphone with a limited data plan.

What are operating expenses?

The total cost formula is important because it helps management calculate the profitability of their business. It helps managers pinpoint which fixed or variable costs could be reduced to increase profit margins. It also helps managers determine the price point for their products and compare the profitability of one product line versus another.

Technology’s role in managing operating costs

In addition, economies of scale enable large organizations to offer the same products as smaller organizations for lower prices. Entrepreneurs can compute their business’s variable cost by multiplying the quantity of the output by the output’s variable cost per unit. Operating expenses are represented on a balance sheet as a liability. Because they are a financial expense that does not directly contribute to selling services or products, they aren’t considered assets. FreshBooks expense tracking software makes it a breeze to track and organize all your operating expenses.

Financial Accounting Treatment

- In other words, variable costs decrease or increase based on the production level.

- This contrasts with operating costs, which are paid for through revenue generated from sales.

- This is demonstrated in the cash flow statement, where the purchase of an asset falls under investing activities.

- Operating costs illuminate the health of daily operations, painting a vivid picture of a company’s efficiency.

Every product sold needs to at least generate enough revenue to cover the fraction of operating costs attributable to its production and sale. If a business underestimates its operating costs, it may incorrectly set lower prices and will likely face difficulties trying to cover these costs, inevitably damaging profitability. By understanding the difference between fixed and variable costs, it becomes easier to allocate resources, set appropriate pricing, and ultimately, improve profitability. If not managed well, an increase in these costs may lead to a decrease in profitability, even if sales are booming.

You can navigate challenges with agility and proficiency in managing operating costs. Cut down unnecessary expenses but ensure quality and growth don’t take a back seat while you’re at it. Operating costs illuminate the health of daily operations, painting a vivid picture of a company’s efficiency. It’s not just about the numbers but their story regarding sustainability, adaptability, and profitability. Having clear benchmarks allows for easier tracking of any deviations.

Diligent accounting of operating expenses keeps profits on growth for continued success. In addition to fixed and variable costs, it is also possible for a company’s operating costs to be considered semi-variable (or “semi-fixed”). These costs represent a mixture of fixed and variable components and can be thought of as existing between fixed costs and variable costs. Semi-variable costs vary in part with increases or decreases in production, like variable costs, but still exist when production is zero, like fixed costs. This is what primarily differentiates semi-variable costs from fixed costs and variable costs. Strong revenue is always a good sign that the company is performing well.

If you are looking to understand how our products will fit with your organisation needs, fill in the form to schedule a demo. Businesses balance short-term cost-cutting with long-term growth by ensuring immediate savings don’t hinder future opportunities or damage brand reputation. Gains or losses from the sale of assets, interest paid on loans, lawsuit settlements. One-time or infrequent, related to obtaining or upgrading physical assets.

The per-unit variable cost of production remains consistent for a given level of output, but the per-unit variable costs will increase as the volume of output increases. Your business profits may increase in the short-term if you choose to reduce specific operating costs, these decisions can impact business earnings in the long-run. These examples show how operating costs vary significantly across industries.

By eliminating these wastes, a business can significantly lower its operating costs. Incorporating lean methodologies or using just-in-time inventory management are a few examples of how companies can reduce waste. One of the approaches to manage operating costs involves optimizing energy usage within the organization. A company’s operating income is determined by subtracting operating costs from gross profit.

Capital costs are one-time expenditures that a company incurs when it buys assets that improve its operations for a long period, typically over a year. These costs, also known as capital expenditure or CapEx, could include expenses like purchasing a new property, upgrading equipment, or investing in technologies. Capital costs are considered an investment in the company’s future performance and productivity. On the other hand, if operating costs are overestimated, prices may be set too high compared to competitors offering the same goods or services, which could push customers away.

- Publicado en Bookkeeping

Accounting for Startups The Ultimate Startup Accounting Guide

Tax season, two dreaded words for anyone, nevermind for a founder. However, if you are organized from the start, know what documents to have and keep good records, it may not be that bad. You could always hand it off to the professional certified public accountants (CPAs) if you just don’t want to deal with it. So we don’t recommend that level of complexity for your seed stage model – just the IS and the cash position (maybe working capital or inventory). This is when you take your financial model or projections and compare them every month to your actual results.

Make informed decisions with books that are right for your business. We work closely with you to get a comprehensive understanding of your business, so that you can run your business more effectively with the information you need to succeed. A report called Profit and Loss is created to show a business entity’s net income or loss in that particular accounting period. We’ve designed month-end close processes for some of the best startups in the game.

What to Consider When Choosing a Bookkeeping Service for Your Startup

During diligence your company will probably face a lot of short turnarounds, and having an accountant supporting you during these urgent requests for financial information can be invaluable. In addition, other emergencies can require assistance from accounting. For example, human resource situations that involve terminating employees can require calculating severance and running payroll, and your accountant can help during these difficult circumstances. Every business owner needs to have a structured method of bookkeeping that records the money coming in and going out of the business.

Award-Winning Customer Support

Grew from a 2-person startup to a NASDAQ listed public company. We set startups up for fundrising success, and know how to work with the top VCs. Merritt Bookkeeping only offers one package at a flat rate of $190 per month. Want to know more about START-UP NY program requirements for participating businesses and schools? Download the regulations (PDF) and the START-UP NY statute (PDF).

Choosing the Right Type of Accounting Service Provider

And by keeping accurate books, you’re more likely to impress investors, creditors, and lenders. Accurate startup accounting will help you keep track of your income and expenses. Yes, platforms like Wave offer free accounting and bookkeeping features, which can be sufficient for startups needing only basic financial tracking. http://klinfm.ru/news/v-klinskom-rajone-sostoyatsya-publichnye-slushaniya-po-voprosu-vozvedeniya-vyshki-sotovoj-svyazi.html Wave is a free accounting software solution that offers bookkeeping features and optional payroll and payment processing add-ons.

What is online bookkeeping?

Tailored primarily to tech startups, Pilot includes specialized support for startups with investor reporting needs. QuickBooks Live is a strong choice for startups already familiar with QuickBooks, providing tailored support and regular account reconciliation. Read our recent blog posts on all things startup, accounting and finance. The research and development, or R&D tax credit, is a US government-sponsored incentive that rewards companies for conducting research and development activities within the United States. Even unprofitable technology companies can use this incentive to reduce their burn rate. Kruze has helped clients reduce their burn rates by over $40 million through our work on this government incentive program.

- If you have investors, they’ll require that you provide financial reports.

- Both bookkeeping and accounting are vital to every business’s success, but you may have an additional need to keep good records as a startup.

- Built for self-employed entrepreneurs, Collective is an all-in-one financial management solution with services for bookkeeping, accounting, formation, taxes, and payroll.

- Access real QuickBooks-certified bookkeepers for your startup’s financial needs.

- Of course, having the right systems set up can dramatically lower the amount of effort required; we’ll get to those systems in a moment.

- It’s an essential part of good business management and business growth.

Resources To Empower Startup Teams

When you know how to read your financial statements, you can find ways to increase your profit and catch problems before they grow. Bench gives you a dedicated bookkeeping team so you have a direct line to your own experts on desktop or mobile–professional support is just a few swipes, taps, or clicks away. Use that data to negotiate volume discounts or to shop around for a better price on that service.

- The term dates back to the olden days when business owners tracked finances in paper books.

- Every business owner needs to have a structured method of bookkeeping that records the money coming in and going out of the business.

- You can create a recurring profile in a few clicks and FreshBooks will automatically send the invoices for you, freeing up time for more important and fulfilling tasks.

- Accurate recordkeeping – known as “bookkeeping”” in the accounting world, is important to ensure you are keeping track of how the company is growing revenue and spending it’s cash.

Other Firms”,”phone”:”

Designed for a startup with multiple departments; use to budget for hiring and non-FTE spend. The Bureau of Labor Statistics states that accounts are paid $78,000 annually or $37.50 per hour on average. Say goodbye to lengthy back-and-forths over email and hello to clear, organized communication with your bookkeeper.

That https://www.emu-land.net/arcade/mame/roms/sc5mombc also makes tax calculation and filing much easier to do. Maintaining accurate accounts will ensure your startup’s financial health, stability, and growth. Vanessa is a CPA and the founder of Kruze Consulting, and has helped hundreds of startups with their accounting and taxes. Vanessa Kruze, a seasoned CPA, has an impressive track record prior to establishing Kruze Consulting. Her experience includes pivotal roles at Deloitte Tax and as a controller for a substantial startup with over 120 employees and $20 million in revenue.

Both bookkeeping and accounting are vital to every business’s success, but you may have an additional need to keep good records as a startup. If you have investors, they’ll require that you provide financial reports. And if you are trying to get a business loan, you’ll need clear and easy-to-read http://cartage.ru/board/spectekhnika_funkcionalno/dorozhnostroitelnaja_tekhnika/9111.html financials so that potential investors can make an informed decision about investing in your vision.

Clients who have worked with Kruze have collectively raised over $15 billion in VC funding. We understand the unique challenges that come with growing a business and have the expertise you need to reach your goals.

- Publicado en Bookkeeping

What Are Cash Equivalents? Types, Features, Examples

It’s also important to point out that the purchase of PP&E (CapEx) has been fairly proportional to depreciation, which indicates the company is consistently reinvesting to keep its assets in good shape. Warren Buffett understands, better than most, the importance of capital returns on investments and the need to find greater and greater investments to generate those returns. Insurance companies earn much of their income from the premiums it collects and a substantial portion from their investment portfolios.

Unitization in Finance: Principles, Types, and Implications

Cash equivalents are not identical to cash in hand, though they have such low risk and high liquidity that they’re often considered as accessible. Companies may intentionally carry higher balances of cash equivalents so they can capitalize on business opportunities when they arise. Instead of locking capital into a long-term, illiquid, and maybe volatile investment, a company can choose to invest added cash in cash equivalents in the event it needs funds quickly. A certificate of deposit is a type of savings account with a financial institution. It represents a certain amount of a saver’s capital that can’t be accessed by the saver for a specific period of time.

Example from Amazon’s Balance Sheet

Commercial paper is a short-term, unsecured promissory note issued by corporations. Debt securities are generally less risky than equity securities and provide regular income, making them attractive for conservative investors. They also play a crucial role in a company’s capital structure, affecting its leverage and interest obligations. Trading securities are bought and held primarily for short-term profit from market price fluctuations. These are recorded at fair value on the balance sheet, with unrealized gains and losses recognized in the income statement.

Accounting for Intercorporate Investments: What You Need to Know

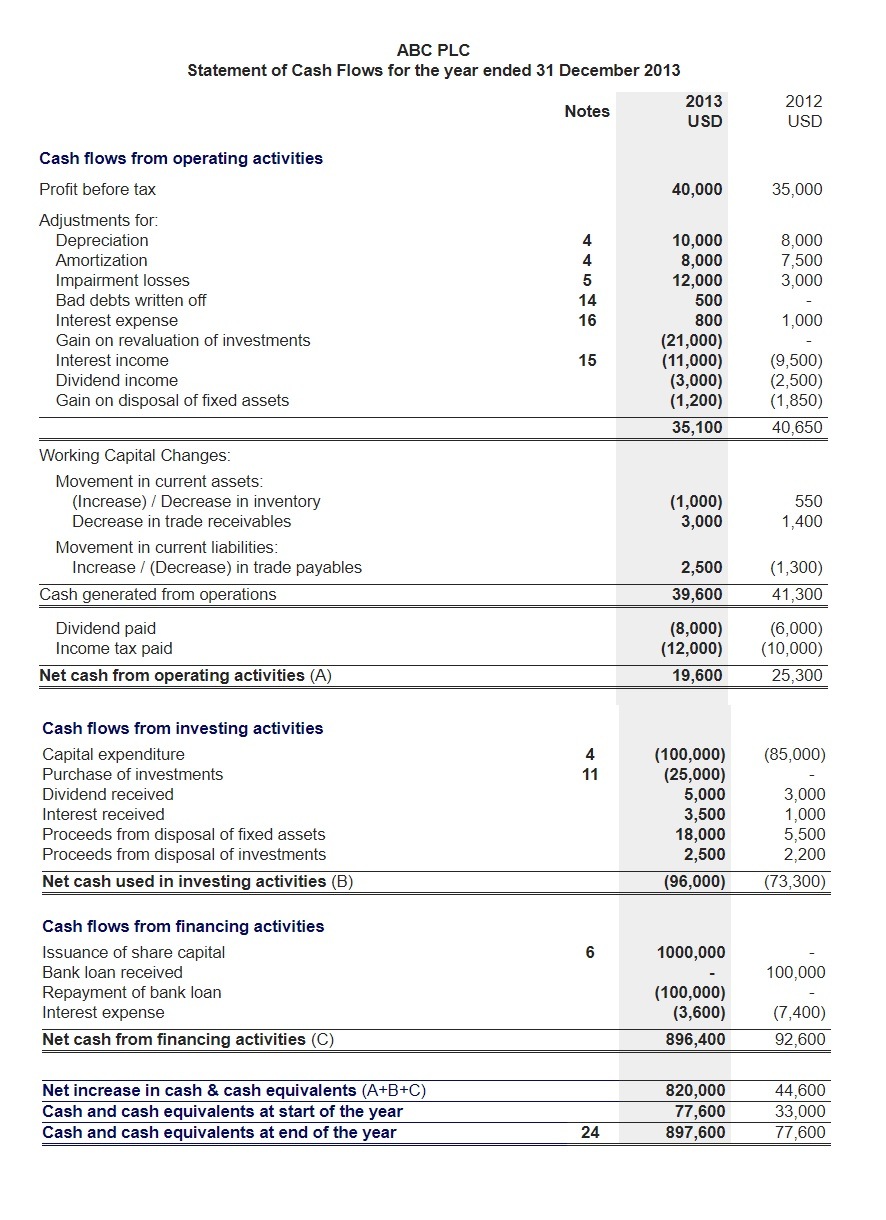

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. One item to remember when looking at the balance sheet and marketable securities. All the line items listed on the balance sheet always appear in order of liquidity.

Marketable securities held by the target company can significantly impact its valuation, as they represent liquid assets that can be quickly converted to cash. Additionally, the presence of high-quality, low-risk marketable securities can make a target company more attractive, as these assets enhance liquidity and reduce financial risk. Properly accounting for these securities ensures that the acquisition price reflects the true value of the target company, facilitating smoother negotiations and integration.

For non-finance professionals, understanding the concepts behind a cash flow statement and other financial documents can be challenging. In financial modeling, it’s critical to have a solid understanding of how to build the investing section of the cash flow statement. The main component is usually CapEx, but there can also be acquisitions of other businesses. There is a direct correlation between an insurance company’s assets and its income, as evidenced by the Prudential income statement and balance sheet. Investing in complex financial companies such as insurance companies requires understanding the business and the different jargon and layout of financial statements.

Where marketable securities are highly liquid and easily converted into cash, non-marketable securities are the exact opposite. For 2021, Airbnb had USD $6,067,438 in cash and cash equivalents, $2,255,038 in marketable securities, and its total current liabilities were $6,359,282. Marketable securities are short-term assets that can easily be converted into cash, as they are simple to buy or sell and generally mature quickly.

- It is part of a figure that helps determine how liquid a company is, its ability to pay expenses, or pay down debt if it needs to liquidate assets into cash to do so.

- Marketable securities play a significant role in portfolio management, offering a blend of liquidity, diversification, and risk management.

- Marketable securities are useful assets for a company to have if they need to raise funds quickly, such as for an acquisition opportunity or to meet a short-term obligation.

- Bankers’ acceptances are frequently used to facilitate transactions where there is little risk for either party.

- In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity.

- Most companies earn most of their income from their core business, as Microsoft earns most of its income from computer hardware, cloud services, and other assorted products.

However, the indirect method also provides a means of reconciling items on the balance sheet to the net income on the income statement. As an accountant prepares the CFS using the indirect method, they can identify increases and decreases in the balance sheet that are the result of non-cash transactions. As for the balance sheet, the net cash flow reported on the CFS should equal the net change in the various line items reported on the balance sheet.

This method is commonly used for securities that are actively traded in public markets, such as stocks and bonds. Changes in fair value are recognized in the financial statements, either through profit or loss or other comprehensive income, depending on the classification of the security. For example, trading securities are measured at fair value with changes recognized in profit or loss, while available-for-sale securities have changes recognized in other comprehensive income. The fair value method provides a transparent view of the current market conditions but can introduce volatility into financial statements due to market fluctuations. An item on the cash flow statement belongs in the investing activities section if it is the result of any gains (or losses) from investments in financial markets and operating subsidiaries. An investing activity also refers to cash spent on investments in capital assets such as property, plant, and equipment, which is collectively referred to as capital expenditure, or CAPEX.

Cash-out transactions in CFF happen when dividends are paid, while cash-in transactions occur when the capital is raised. Prudential lists on the income statement as net investment income, such as below. Any dividends or sales of those marketable what gamestop gains and losses mean for your taxes equities contribute to those companies bottom lines. Most companies earn most of their income from their core business, as Microsoft earns most of its income from computer hardware, cloud services, and other assorted products.

A cash flow statement is a valuable measure of strength, profitability, and the long-term future outlook of a company. The CFS can help determine whether a company has enough liquidity or cash to pay its expenses. A company can use a CFS to predict future cash flow, which helps with budgeting matters. Analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success. The CFS should also be considered in unison with the other two financial statements (see below). Like people, companies should maintain enough easily accessible cash to handle unexpected costs that might arise, for instance, when business is slow or the economy stumbles.

- Publicado en Bookkeeping

Small Business Bookkeeping Services

Thankfully, online bookkeeping services have lowered the financial barrier to getting bookkeeping and tax-related help. For small businesses, monthly bookkeeping services provide a regular financial pulse check, helping you identify opportunities and mitigate risks before they grow. You can search the web for QuickBooks bookkeeping services but always seek a reputable specialist. Your bookkeeper should have QuickBooks certification and numerous organic positive customer ratings. Many small businesses enjoy having a dedicated team to handle all of their monthly bookkeeping, and using accounting software is a smart addition.

- Communication with an outsourced bookkeeping service provider like Fourlane will include scheduling a call and discussing your needs.

- And since tax time stress isn’t limited to tax season, year-round tax advisory services comes standard.

- Susan Guillory is an intuitive business coach and content magic maker.

- On this call, we’ll connect your accounts to Bench, and gather any extra documentation we need to complete your books.

Why Monthly Bookkeeping Matters

Investing in monthly bookkeeping ensures that your finances are always in top shape. That’s where services like doola’s Monthly Bookkeeping come into play, offering comprehensive solutions to keep your finances on track. According to studies, 82% of small businesses fail due to cash flow mismanagement, highlighting the importance of consistent financial oversight. Bookkeeping, often considered the backbone of financial management, is essential for tracking income, expenses, and overall business health. With our dedicated attention to detail, businesses can reduce errors in order fulfillment while gaining deeper insights into costs, all while making use of the platform’s CRM features within the same application.

See Bench’s features in action

- Providers of bookkeeping services also often invoice clients’ customers, pay their bills, and process their payroll.

- Our bookkeepers reconcile your accounts, categorize your transactions, and make necessary adjustments to your books.

- Billy/Sunrise also got some bad reps for its choices regarding customer loyalty when it was acquired.

- Online bookkeeping services typically give you a dedicated bookkeeper or team of financial experts to help you with basic bookkeeping tasks.

We understand every company faces unique challenges, and that extends to its finances. To maintain accurate books and capture more tax deductions, we make it easy to add business transactions from your personal accounts to Bench. If you’re what are retained earnings several years behind on your bookkeeping and taxes, you can get caught up and filed with Catch Up Bookkeeping. Personal FICO credit scores and other credit scores are used to represent the creditworthiness of a person and may be one indicator to the credit or financing type you are eligible for. Nav uses the Vantage 3.0 credit score to determine which credit offers are recommended which may differ from the credit score used by lenders and service providers. However, credit score alone does not guarantee or imply approval for any credit card, financing, or service offer.

Training Made Easy

Fourlane’s consultants have collaborated with thousands of businesses across diverse industries to help tailor QuickBooks and their ERP systems to fit their industry’s unique needs. Your project commences with the end goal of getting the right data to make informed business decisions. Bring years of best practices on accounting and financial reporting to your team. Move your business from “what we’ve been doing” to “what the best businesses do.” Every report accessible in the Bench platform can be exported to an Excel file for easy sharing with anyone from business partners to Bookstime accountants. You won’t need any other software to work with Bench—we do everything within the platform.

- If you’re switching from QuickBooks, we’ll work from your closing balances to do your bookkeeping going forward.

- Book a demo today to see what running your business is like with Bench.

- This being said, however, QuickBooks Live does not include payroll setup, administration, or support.

- Trained accountants and bookkeepers manage financial complexities and offer practical business solutions.

- Therefore, you’ll also have to consider the cost of your QuickBooks plan, in addition to the cost of QuickBooks Live Bookkeeping.

- The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses.

Payroll Software

In addition, Bench has raving online reviews and many integration options. Every online bookkeeping service will offer a mixture of different features ranging from basic to advanced. As a result, a suite of features from one service will appeal more to very small businesses, while an entirely other set of features from another service might appeal to larger small businesses. You can use the pricing tool on the Bookkeeper360 website to test out all the bookkeeper services near me pricing combinations for each plan. The Business plan starts at $125/month for tax planning and advice but to get business or personal tax preparation you’ll need a Corporation plan at $225/month. Bookkeeping services are available on the Enterprise plan with costs $375/month.

- Publicado en Bookkeeping

The Choice Between Income and Consumption Taxes: A Primer

Japan, Australia, New Zealand, Singapore, Canada, and India are among the countries with a form of national consumption tax. Ideally, a properly designed consumption tax system would reward savers and penalize spenders. While the U.S. does not have a national consumption tax, many other countries have imposed some form of a national consumption tax. A consumption tax system would encourage saving while punishing spending in a perfect world.

Benefits of Consumption Taxes

In the long run, as measured on a conventional basis, after-tax income of all taxpayers increases slightly on average, as the plan is roughly revenue neutral. The bottom 20 percent of taxpayers would see an increase in after-tax income of 5.5 percent. On a dynamic basis, after-tax income increases by 0.3 percent on average, when factoring in the positive economic effects of the reform.

Modeling Consumption Tax Reforms for the United States

- A consumption tax, in contrast to income taxes, which penalize savers and reward spenders, is said to promote consumer spending and increase economic efficiency.

- Simulations of moving to a consumption tax and econometric studies of policies that incrementally move away from taxing income toward taxing consumption point to the benefits of taxing consumption rather than income in terms of economic growth and increases in welfare.

- Businesses, a lot of businesses don’t like tax reform because they lose deductions for payroll taxes and other things.

- Because Taxpayer B does not immediately consume her earnings, she would not face an initial tax, instead saving all $100 of her earnings.

- Reforming the current income tax system toward a consumption tax system would support rising living standards and economic growth.

Although they still taxed income broadly, some sought to eliminate the prevalence of double taxation by eliminating taxes land depreciation on dividends and inheritances, moving closer to a consumption tax system. Canada levies a federal value-added tax (called the Goods and Services Tax, or GST) at a rate of 5 percent. The GST in Canada replaced an earlier tax called the Manufacturer’s Sales Tax (MST). The significant and varied experience of OECD countries with VATs can inform the debate of adopting a consumption tax in the U.S.

Background on Consumption Taxes

The QST is structured the same way as the GST in a bank reconciliation deposits in transit should be and HST, but it is administered separately by Revenue Quebec (which also administers the GST in the province). Additionally, some provinces levy a completely separate retail sales tax that is not a VAT. A consumption tax thus results in a neutral tax burden between uses of income. It removes the income tax bias against saving and results in the same effective tax rate on income no matter if it is consumed now or consumed in the future. Though higher-income households save more, treating income neutrally no matter its use is completely separate from the distributional burden of a tax, as any tax type can be structured to meet various distributional goals.

What is national consumption tax? What House Republicans want to change with FairTax Act.

Reforming the current income tax system toward a consumption tax system would support rising living standards and economic growth. Combined with a simpler system of providing tax credits for individuals and children, such a reform could reduce the economic, administrative, and compliance costs imposed by the current tax system. An income tax, in contrast, is imposed when you earn money, a consumption tax is imposed when an you spend money.

Taxpayer A’s situation would remain the same, paying a 20 percent consumption tax on her immediate consumption, yielding $80 of immediate consumption and a 20 percent effective tax rate. In addition to economic costs, government agencies incur administrative costs as they enforce tax rules and individuals incur compliance costs as they spend time and money to follow tax rules. Import duties are taxes levied on an importer for goods entering the country. The taxes are passed on by the importer to final consumers through higher costs.

Income taxes generally levy indinero reviews a tax on taxpayers when they earn money and when they see changes in their net worth, such as from returns from saving and investment. That’s because income is either consumed immediately when it is earned or, if consumption is deferred by saving, income is consumed in the future after it has been saved. We begin with background on consumption taxes and how they can be structured followed by a review of studies and international examples of consumption taxes. We then turn to an overview of the current U.S. tax system and model two tax reform options.

- Publicado en Bookkeeping

How to Find and Calculate Retained Earnings in 2024

This amount comes after deducting all expenses for a period from the total income. When these amounts accumulate for several periods, they go to the retained earnings account. However, these amounts only include profits not paid to shareholders in previous periods.

- As a result of higher net income, more money is allocated to retained earnings after any money spent on debt reduction, business investment, or dividends.

- Retained earnings reflect the company’s net income (or loss) after the subtraction of dividends paid to investors.

- It’s often the most important number, as it describes how a company performs financially.

- This profit is often paid out to shareholders, but it can also be reinvested back into the company for growth purposes.

What Factors Impact Retained Earnings?

- Retained earnings may be used to acquire new assets, pay off debts, or finance operations.

- Shareholder equity represents the amount left over for shareholders if a company pays off all of its liabilities.

- Understanding retained earnings is essential for anyone involved in business.

- Negative retained earnings are a sign of poor financial health as it means that a company has experienced losses in the previous year, specifically, a net income loss.

- For example, companies often prepare comparative income statements to analyze reports over several years.

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first are retained earnings an asset or liability six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

How to Calculate Retained Earnings

At each reporting date, companies add net income to the retained earnings, net of any deductions. Dividends, which are a distribution of a company’s equity to the shareholders, are deducted from net income because the dividend reduces the amount of equity left in accounting the company. Retained earnings are recorded in the shareholder equity section of the balance sheet rather than the asset section and usually do not consist solely of cash. Dividend payments can vary widely, depending on the company and the firm’s industry. Established businesses that generate consistent earnings make larger dividend payouts, on average, because they have larger retained earnings balances in place.

Where Is Retained Earnings on a Balance Sheet?

By investing in research and development, businesses can develop innovative products and services and maintain a competitive edge in the market. Similarly, the iPhone maker, whose fiscal year ends in September, had $70.4 billion in retained earnings as of September 2018.

- If the company is experiencing a net loss on its Income Statement, then the net loss is subtracted from the existing retained earnings.

- Over time, retained earnings can have a significant impact on a company’s growth and profitability.

- Net income is often called the bottom line since it sits at the bottom of the income statement and provides detail on a company’s earnings after all expenses have been paid.

- Lower retained earnings can indicate that a company is more mature, and has limited opportunities for further growth, but this isn’t necessarily a negative.

- She supports small businesses in growing to their first six figures and beyond.

A report of the movements in retained earnings is presented along with other comprehensive income and changes in share capital in the statement of changes in equity. It is recorded into the Retained Earnings account, which is reported in the Stockholder’s Equity section of the company’s balance sheet. The amount is usually invested in assets or used to reduce liabilities.

Retained earnings are the amount of net income a company has left after dividends have been paid to shareholders. They can be used for a variety of purposes, such as capital investments, debt reduction or expansion. This capital has the potential to increase over time, and is a valuable asset to shareholders. Retained earnings do not belong to the company, but to the shareholders.They can be reinvested in the company or distributed to shareholders as dividends. The funds are used to pay shareholders in the form of dividends or compensation, and while they are not considered assets of the company, they are an additional equity shareholder capital. They both may see them as working capital to pay off high-interest debt or invest in growth that will make the company even more profitable given some more time.

- Publicado en Bookkeeping

QuickBooks Enterprise Pricing 2024 Guide

QuickBooks Online is one of the company’s most popular accounting software choices for small-business owners. QuickBooks Online pricing is based on a monthly subscription model, and each plan includes a specific number of users. First-time QuickBooks Online users can typically receive a free 30-day trial or a discount for the first few months of service. Users can switch plans or cancel without having to pay termination fees. Live customer support is available by online chat and callback weekdays during extended business hours and on Saturdays.

Check For QuickBooks Online Sales & Discounts

For instance, with QuickBooks Online, your security is handled by QuickBooks. However, as QuickBooks Desktop is locally installed, you’ll be responsible for your own data security. For just $50, QuickBooks Live Bookkeeping will set you up with an expert for one session. You’ll be able to track bills, set up recurring billing, track expenses, record payments in multiple currencies, and scan bills to keep abreast of all the money your company is owed.

Additional QuickBooks Pro Costs

You can request a callback anytime when you need a little extra help. Use the apps you know and love to keep your business running smoothly.

Plans for every kind of business

In addition to the basic QuickBooks Enterprise features, QuickBooks Enterprise Platinum also includes advanced inventory, advanced pricing, and bill workflow approvals. If you need more mobility than this locally installed software offers, you can sign up for the QuickBooks Gold with cloud access packages. QuickBooks Premier has almost all of the same potential additional fees as QuickBooks Pro, with a few minor variations what financial statement lists retained earnings in cost.

As a top-tier accounting software, QuickBooks has long helped small and medium-sized businesses streamline their financial management. QuickBooks Enterprise is the most sophisticated QuickBooks product, serving as an end-to-end software solution. It combines inventory management, payroll and sales tracking as part of its comprehensive suite of features. In this article, we’ll compare the available QuickBooks Enterprise pricing plans to help you select the best match for your business.

Once your business is large enough to require more automation and more employees, the Plus Plan likely makes sense, as it allows for recurring payments in addition to time tracking. It also includes inventory tracking, making it a must for an operation that sells more than a few products. Due in part to these reasons, QuickBooks is our pick for the best hospitality accounting software. Read on for a breakdown of QuickBooks Online plans and costs, along with guidance on which package is right for your business. From pros and cons to hidden fees and add-ons, we’ll explain everything you need to know about this top-rated accounting software and its pricing. QuickBooks Desktop Pro Plus is ideal for small businesses that need robust, locally installed accounting software for up to three users.

Most integrations come with additional monthly subscription fees, so be sure to account for these extra costs when calculating how much QuickBooks is going to set you back. QuickBooks Enterprise has significantly fewer additional fees than QuickBooks Pro and Premier since many features are included with your annual subscription. QuickBooks Online offers four pricing plans that start at $35/month and cost up to $235/month, depending on the number of features and users your business needs.

With five plans, each at different price points, users can choose the plan that best meets their business needs without paying for additional features that they don’t want. As a business grows, users can easily upgrade to a more advanced plan with additional features seamlessly. QuickBooks is the platform most used by professional accountants so if you plan to work with an accountant, they will likely be very familiar with the platform, its features and capabilities.

- When it seems like there is a business software application for everything, it pays to be choosy.

- Once they were done, they compiled all category scores for each brand into a single 5-point score.

- Each of these versions gives you access to specialized features and reports at no additional cost.

- However, the “Secure” brand of checks offer in-depth fraud protection measures that may justify the price, provided you anticipate security risks at your business.

- Your data is securely backed up and you have instant access to the latest product and feature updates.

QuickBooks makes this process even easier thanks to a huge range of integrations and plug-ins you can use, with familiar names such as PayPal, Shopify and MailChimp all present and accounted for. Zoho Books has a free plan, while QuickBooks does not, and both Zoho Books and QuickBooks offer a large range of features on their higher-priced plans. It’s one of the most popular accounting software options in the world, and our researchers ranked it the highest overall, meaning that it’s the top pick for the average business, small or large.

- Publicado en Bookkeeping

- 1

- 2